It has only just announced its IPO plans, but Groupon is already getting a bitter taste of the brutality of being more public in an increasing series of negative reports aimed at its business prospects and execs.

That has included a spate of posts after it filed to go public last week about the unusual accounting treatment in an S-1 regulatory filing for the offering, which also showed a large outflow of its venture funding to the pockets of the Chicago-based social buying site’s founders.

Since then, though, the gloves seem to be off for Groupon, just as it starts to market itself to Wall Street investors.

Perhaps the toughest so far has been one written by Fortune’s Kevin Kelleher, painting a very sketchy investing portrait of the company’s Chairman and co-founder Eric Lefkofsky.

Wrote Kelleher in a piece titled “The Checkered Past of Groupon’s Chairman”:

But Groupon’s IPO has brought an uncomfortable spotlight onto Lefkofsky. While some attention focuses on his ambitions as an investor in tech start-ups, others see a “spotty history” and draw parallels between the past and the present. Lefkofsky’s track record, reflecting failures and successes, bears certain hallmarks: Rapid revenue growth accompanied by big losses, a penchant to sell stock early on, and lawsuits filed by investors, lenders or customers who feel they have been wronged.

Ouch.

While one of the lawsuits mentioned in the piece was dismissed with prejudice, it did not help that the piece included an early email used in the case, written by Lefkofsky in the Web 1.0 era, that read in part:

“Lets start having fun…lets get funky…let’s announce everything…let’s be WILDLY positive in our forecasts…lets take this thing to the extreme…if we get wacked [sic] on the ride down-who gives a shit…THE TIME TO GET RADICAL IS NOW…WE HAVE NOTHING TO LOSE…”

Double ouch, even if it is probably a bit unfair to use such rookie remarks from a young entrepreneur back then to reflect on him today.

Still, Lefkofsky — whom I met with recently at Groupon’s HQ and found as whip-smart and savvy as any Silicon Valley sharpie — does seem to need to be more circumspect in his utterances today.

Most specifically, the day after its IPO filing, he told Bloomberg in an interview that Groupon will be “wildly profitable,” referencing worries about losses unveiled in its financial statements and his past record of start-ups.

Said Lefkofsky on June 3:

“I’m going to be in technology for a long time. I’m going to start a lot of companies. These are not sham companies. These are great businesses. InnerWorkings is profitable. Echo is profitable. Groupon is going to be wildly profitable.”

While sources said it is unlikely that Groupon will be forced by the Securities and Exchange Commission to make a new filing due to the remarks, it’s just the kind of mistake the typically voluble company needs to avoid going forward.

In other words, no more words from Groupon.

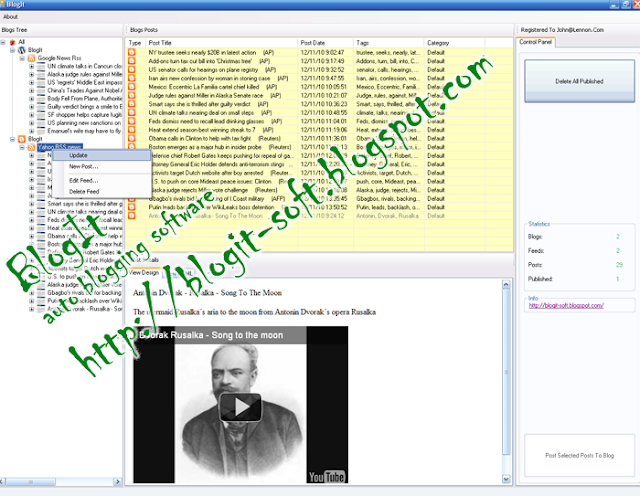

Generated by BlogIt

BlogIt - Auto Blogging Software for YOU!

No comments:

Post a Comment