First, let it be said that Yahoo shareholders are a long-suffering group, enduring year after year of mishaps and mishegas with unusual patience.

Still — with the stock of the Silicon Valley Internet giant continuing a worrisome downward movement, closing just below $15 a share both Wednesday and again yesterday — could some of its major investors decide to get angry at Yahoo management and its board at next week’s annual meeting?

So far, a mass shareholder withholding of votes for board members, as has happened before, is not likely, despite some serious recent missteps in China, a continued talent drain and worries about Yahoo’s search deal with Microsoft.

And, of course, there is Yahoo’s lackluster stock, which closed at $14.77 yesterday. That’s nearly a three percent fall for the week and a 6.5 percent decline for the month, losses in value that outpace most other Web companies.

It is not entirely clear exactly what is causing the fall. Culprits may include: An overall weak market; continued uncertainty about Yahoo’s Chinese assets and their worth; recent aggressive moves in the display advertising market by Google; and, well, investor dissatisfaction with its current management.

It will be interesting to see what the mood of the Yahoo annual meeting is next week, which is taking place next Thursday morning at a Santa Clara, Calif., location near its Sunnyvale HQ.

Also on the agenda, a big strategy meeting by Yahoo’s directors, who will apparently be querying its execs, especially CEO Carol Bartz, about the vision and growth plans to get the company’s share price cooking again.

Which is actually a meeting shareholders might like to watch.

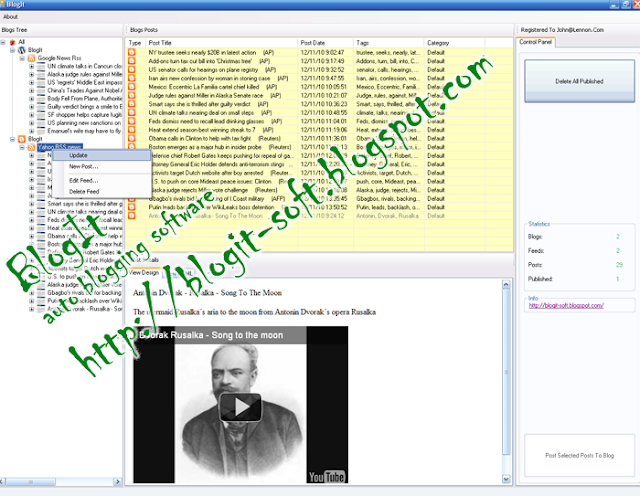

Generated by BlogIt

BlogIt - Auto Blogging Software for YOU!

No comments:

Post a Comment