And then there was one?

According to sources close to the situation, News Corp. is down to one possible investing group in its quest to make lemonade out of the lemon that its Myspace social entertainment hub has become.

In the lastest of many scenarios considered, several sources said its owner, News Corp., will continue to own about 20 percent of Myspace. The main bidder is a dark horse bidding group, which includes Activision Chairman and CEO Bobby Kotick as one of the potential investors.

The deal, cautioned sources, is not final and could easily fall apart.

Interestingly, if such a deal is struck, he would apparently be involved as an individual and not for the giant gaming company, and would play no management role in the company.

Kotick would presumably need permission from Activision for such a high-profile investment, even if he played a smaller role.

Kotick’s possible involvement has not been mentioned in previous reports.

Sources said the other possible bidders — including music video service Vevo, a group including Myspace founder and former CEO Chris DeWolfe, an internal effort by current CEO Mike Jones, several private equity firms and even myYearbook — mentioned in past reports have not worked out for various reasons.

Vevo had seemed the likeliest winner, but its bid appears to have foundered for now, due to the complex nature of its music label ownership.

It is not clear what the price will be for Myspace, which was once the leading social networking site before the world dis-Liked it for Facebook.

One thing is certain: It is nowhere near the $100 million that News Corp. reportedly sought.

The site — even after an overhaul to focus on entertainment — has recently been losing money and traffic, although it is still a large destination on the Web.

News Corp. declined comment, as did Kotick.

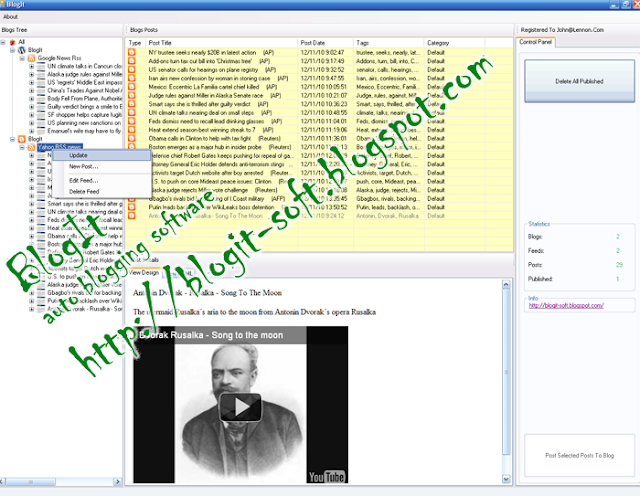

Generated by BlogIt

BlogIt - Auto Blogging Software for YOU!